Compulsory portion: On the amount of the compulsory portion of the spouse

1. Overview

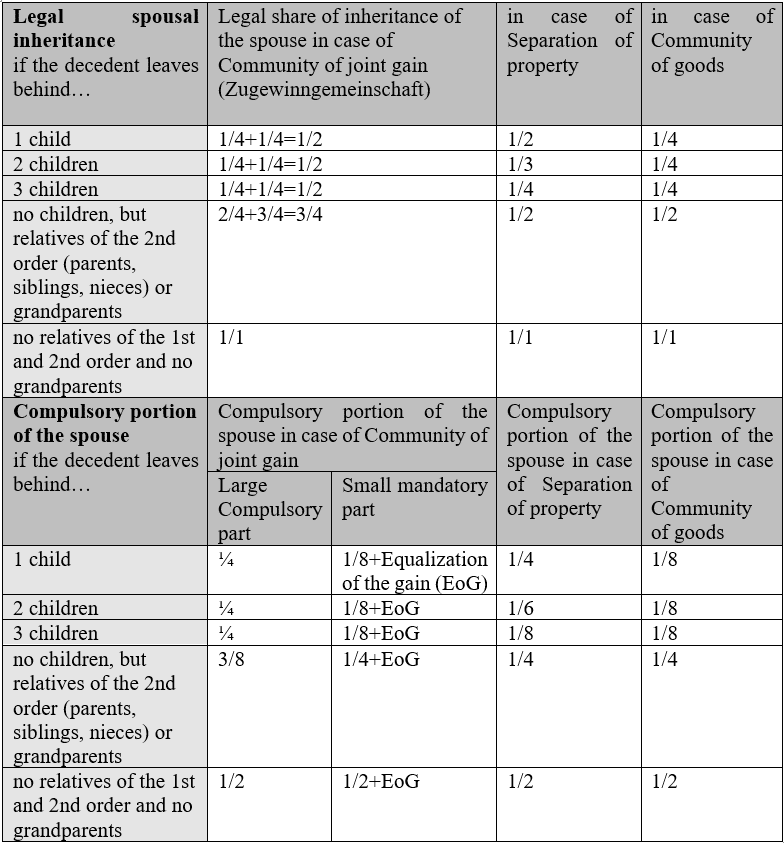

Pursuant to Sec. 2303 (1) Sentence 2 of the German Civil Code, the claim to the compulsory portion consists of half the value of the statutory share of the inheritance. The statutory share of the inheritance is therefore the starting point for determining the compulsory portion. It should be noted that the determination of the statutory inheritance share of the surviving spouse is only fictitious in order to be able to determine the compulsory portion. The surviving spouse, who is entitled to the compulsory portion, does not become the legal heir, because the legal succession only ever takes effect if the testator has not stipulated a different succession by will or contract of inheritance.

When determining the spouse's compulsory share, therefore, the special features of determining the statutory inheritance share must also be taken into account. The statutory inheritance quota of the spouse depends, on the one hand, on the matrimonial property regime in which the spouses lived at the time of the inheritance and, on the other hand, on the relatives of the deceased who were alive at the time of the inheritance.

2. Compulsory portion of the spouse in case of Community of joint gain

In Germany, most married couples are subject to the matrimonial property regime of community of gains. This is the statutory matrimonial property regime that applies automatically if the spouses have not reached any other agreement. Only a prenuptial agreement can change the matrimonial property regime and the spouses have the option of choosing between modified community of gains, community of property or separation of property. Equalization of gains means, with regard to this, that the spouse who has earned less property than the other during the marriage is entitled to equalization (Section 1378 of the German Civil Code). The right to equalization of gains arises with the termination of the matrimonial property regime of the community of gains. This can be terminated in various ways, by death, divorce or also by a change in the matrimonial property regime. In the event that the marital property regime of the community of accrued gains is terminated by death, the law contains special provisions, which will be discussed later.

3. Determination of the fictitious statutory inheritance quota of the spouse

If the decedent lived under the legal matrimonial property regime of community of gains, the amount of the spouse's statutory share of the inheritance initially depends on whether the decedent left close relatives in addition to the spouse, namely statutory heirs of the 1st or 2nd order. Pursuant to Section 1931 (1) of the German Civil Code, the surviving spouse's statutory share of the inheritance is ¼ in addition to relatives of the first order (children, grandchildren), and ½ in addition to relatives of the 2nd order (parents, siblings, nephews and nieces of the deceased) or grandparents.

4. Statutory spousal inheritance quota alongside children of the decedent

If the decedent leaves children or grandchildren, the surviving spouse's statutory share of the inheritance is therefore initially ¼. In the community of accrued gains, this quarter is then increased by a further quarter for the purpose of the lump-sum equalization of the accrued gains of the surviving spouse in accordance with section 1371 (1) of the German Civil Code, so that the statutory inheritance quota of the surviving spouse - as the starting point for determining the compulsory portion quota - is ½ in total in this case (increased inheritance quota).

5. Statutory spousal inheritance quota in addition to grandparents, parents, siblings or nieces of the decedent

If, on the other hand, the deceased had no children but left siblings, for example, the spouse's statutory share of the inheritance is ½ in accordance with section 1931(1) of the German Civil Code. This share of the inheritance is again increased by ¼ in accordance with Section 1371 (1) BGB in the community of accrued gains, so that the surviving spouse - if there were no testamentary disposition and he/she were therefore the legal heir - would be the legal heir alongside the decedent's siblings with a total share of ¾.

6. Large or small compulsory part

Since, as just shown, the spouse's statutory share of the inheritance is increased by ¼ for the lump-sum settlement of the gain, the question arises as to whether this increase must also be taken into account if the spouse does not become the statutory heir at all but claims his or her compulsory share. Since the compulsory portion pursuant to Sec. 2303 (1) Sentence 2 BGB is half the value of the statutory share of the estate, the surviving spouse's compulsory portion would be either ¼ or only 1/8 if the decedent left descendants (children, grandchildren), depending on whether the increase to compensate for the gain is taken into account when determining the notional statutory share of the estate or not. If the deceased leaves no descendants but grandparents, parents, siblings, nephews or nieces, the compulsory portion would be either 3/8 (half of ¾) or only ¼ (half of ½), depending on whether or not the increase to compensate for the gain is taken into account when determining the notional statutory inheritance quota.

7. Small compulsory portion in the event of disinheritance of the spouse

If the surviving spouse is neither an heir nor a legatee, i.e. if he or she is not included at all in the testator's last will and testament, the surviving spouse's share of the compulsory portion is determined on the basis of the non-increased statutory share of the inheritance. In this respect, one speaks of the "small compulsory portion" as half of the non-increased statutory spouse's share of the inheritance. In addition, the surviving spouse can demand compensation from the heir or heirs for equalization of gains (section 1371 (2) of the German Civil Code). This is also known as the "property law solution". If the decedent leaves descendants, the small compulsory portion is 1/8 (half of ¼). If the deceased leaves no descendants, but grandparents, parents, siblings, nephews or nieces, the small compulsory portion is ¼ (half of ½).

8. Large compulsory portion in the case the spouse is designated as an heir by will or has been granted a legacy

If the spouse is designated as an heir by will or if he or she has been granted a legacy, the surviving spouse may reject the inheritance or the legacy and, in addition to the small compulsory portion described, claim compensation for the specific gain to be determined in accordance with the provisions that apply to the equalization of gains in the event of divorce (section 1371 (2) of the German Civil Code). If the spouse does not reject his or her share of the inheritance or the legacy granted to him or her, he or she cannot claim the specific equalization of gains (see above). However, the spouse who has been designated as an heir at will or who has been granted a legacy may, under certain conditions, also claim the so-called large compulsory portion. The large compulsory share corresponds to half of the increased statutory spouse's share of the inheritance. If the decedent leaves descendants, the large compulsory portion is 1/4 (half of 1/2). If the deceased leaves no descendants, but grandparents, parents, siblings, nephews or nieces, the large compulsory portion is 3/8 (half of ¾).

This large compulsory portion is relevant if the surviving spouse has become a spouse or legatee but less than this large compulsory portion was bequeathed to him or her in economic terms. In this case, the surviving spouse may also retain the benefit in accordance with section 2305 of the German Civil Code and in addition claim the so-called additional compulsory portion. In order to determine the additional compulsory portion, the increased statutory spouse's share of the inheritance must then be taken as a basis, i.e. the large compulsory portion. If the surviving spouse decides not to reject the ("small") inheritance or the ("small") legacy and to claim the additional compulsory portion as the large compulsory portion, he or she cannot additionally claim the actual equalization of gains. The surviving spouse can only do this if - as explained above - he or she rejects the bequest and claims the small compulsory portion. From the point of view of the spouse claiming the additional compulsory portion, however, the provision in section 2305 of the German Civil Code is particularly disadvantageous in that burdens of the type specified in section 2306 of the German Civil Code, i.e. in particular burdens due to legacies, are not taken into account when calculating the value.

The large compulsory portion is also important in the assertion of claims to a supplementary compulsory portion under section 2325 of the German Civil Code. Like the supplementary compulsory portion under section 2305 of the German Civil Code, these do not require the beneficiary to disclaim the inheritance or legacy. The calculation of claims to a supplementary compulsory portion by an heir or legatee must then be based on the large compulsory portion.

9. Right of choice: matrimonial property regime or large compulsory portion

The spouse who has been designated as an heir at will or who has been granted a legacy therefore has a choice as to whether to reject the bequest and then claim the small compulsory portion and the specific equalization of gains (see above) or whether to accept the joint inheritance or the legacy and, if applicable, claim the large compulsory portion as an additional compulsory portion or compulsory portion supplement. This requires a weighing of interests. The surviving spouse who has received a bequest should therefore clarify whether the specific equalization of gains and the small compulsory portion are economically more interesting than participation in the estate and, if applicable, a supplement to the large compulsory portion. It may also have to be taken into account that the position as co-heir is also associated with a better position for obtaining information and that disposals of the estate are generally not possible without the consent of the co-heir. The position as co-heir therefore also has a strategic significance which should not be underestimated.

To avoid misunderstandings: If the surviving spouse is neither an heir nor a legatee, i.e. if he or she is not included in the testator's testamentary disposition, he or she does not have the right to choose. In this case, the matrimonial property regime automatically applies. The surviving spouse then receives the small compulsory portion and the specific equalization of gains to be calculated.